Foundation

Financials

SickKids Foundation is committed to the highest standards of accountability and transparency. We were among the first nationally accredited charities under Imagine Canada’s Standards Program. Click below to download SickKids Foundation’s audited financials.

| Sources of Revenue (in Millions) | Amount |

|---|---|

| Gross fundraising program, net lottery and net parking revenue | $213.7 million |

| Total grants and charitable activity | $175.1 million |

| Fundraising and administrative expenses | $60.9 million |

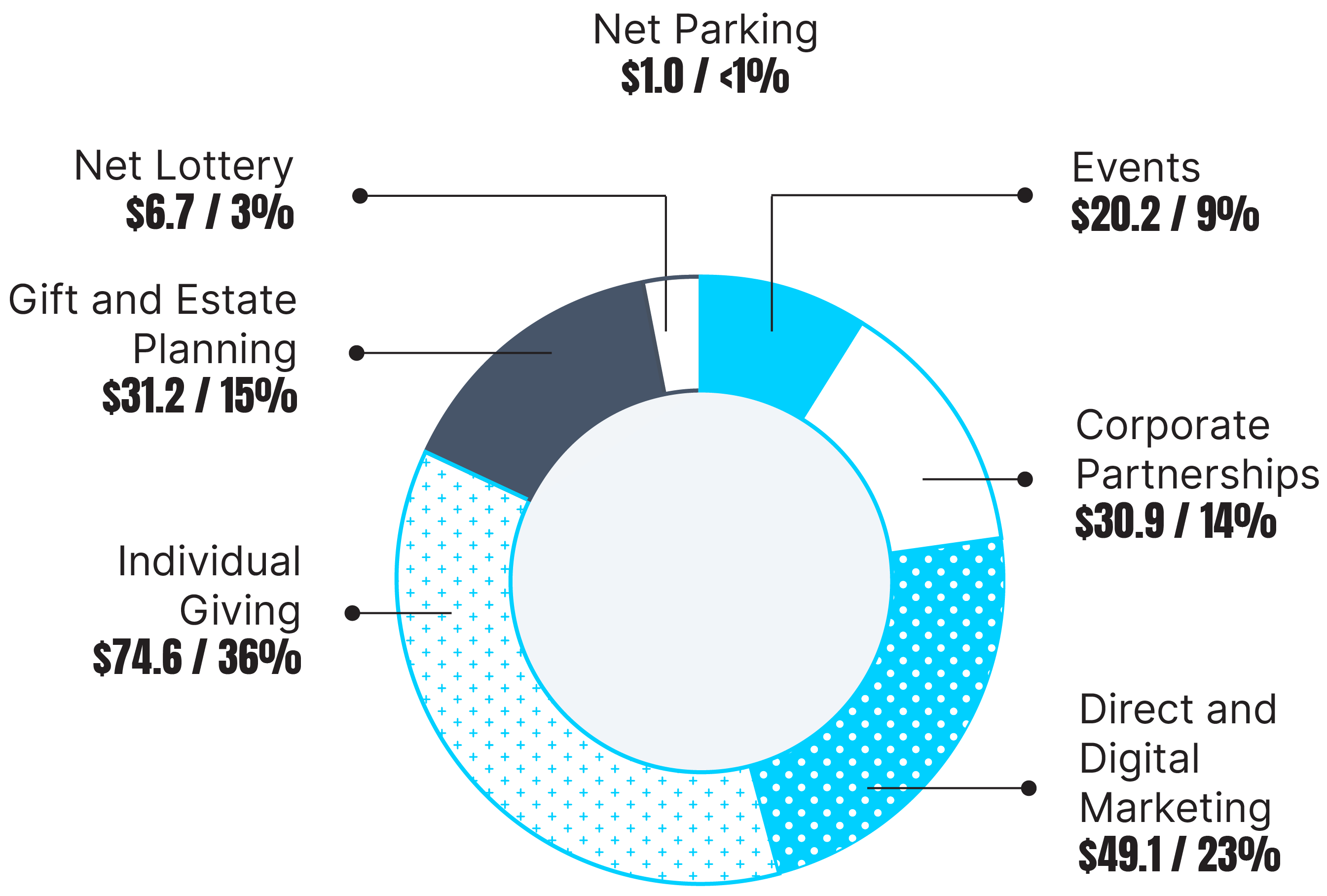

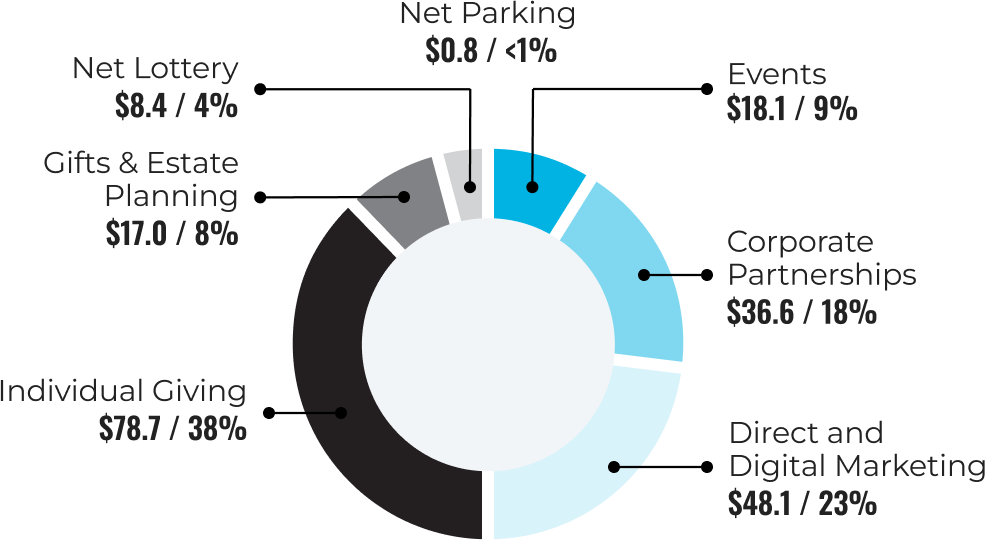

| Sources of Revenue | Amount in Millions | Percentage of Total Revenue |

|---|---|---|

| Events | $20.2 million | 9% |

| Corporate Partnerships | $30.9 million | 14% |

| Direct and Digital Marketing | $49.1 millon | 23% |

| Individual Giving | $74.6 milion | 36% |

| Gifts & Estate Planning | $31.2 million | 15% |

| Net Lottery | $6.7 million | 3% |

| Net Parking | $1.0 million | 1% |

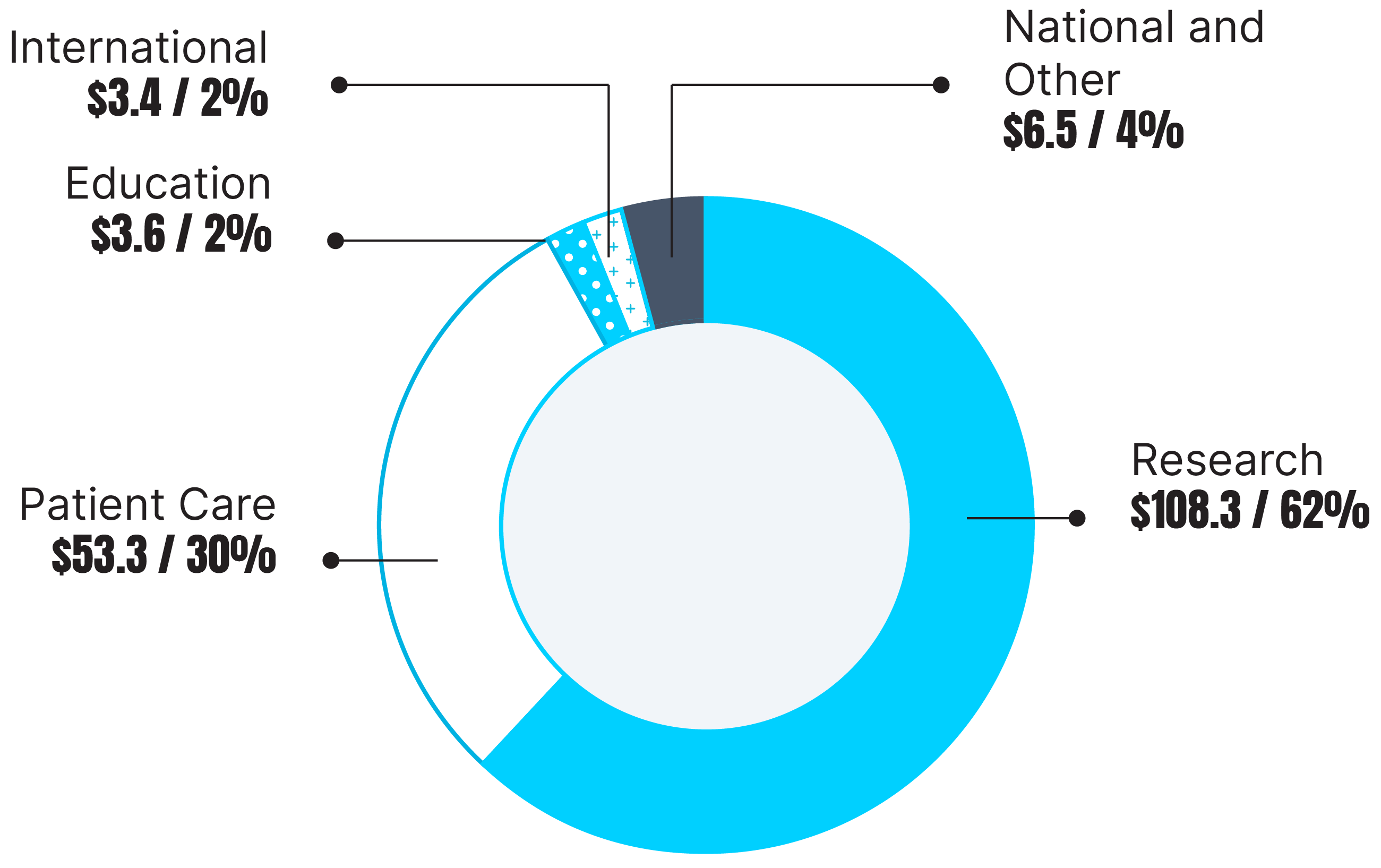

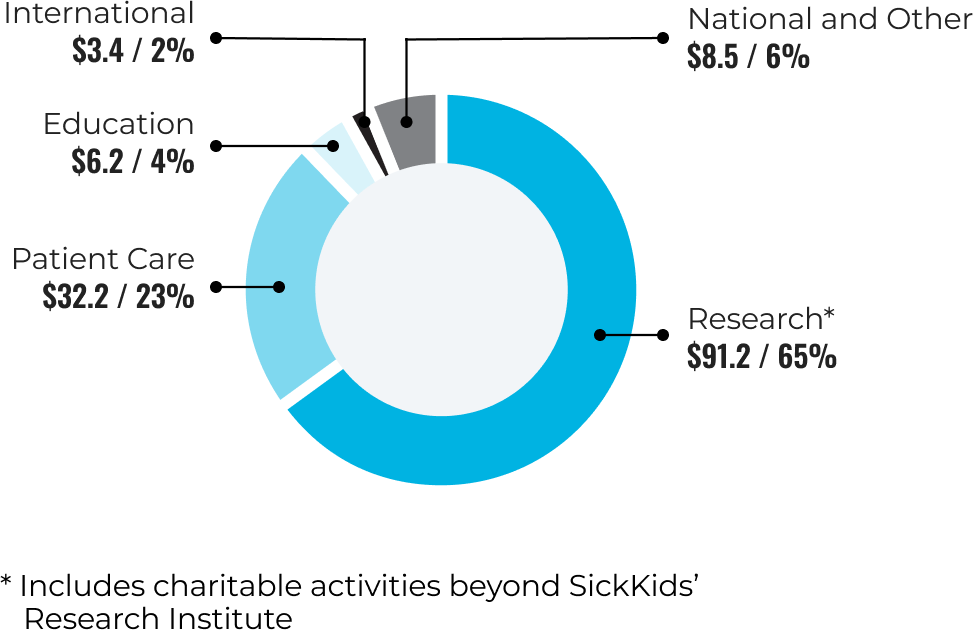

| Investments in Child Health (Grants and Charitable Activity in Millions) | Revenue | Percentage |

|---|---|---|

| Research | $108.3 million | 62% |

| Patient Care | $53.3 million | 30% |

| Education | $3.6 million | 2% |

| International | $3.4 million | 2% |

| National and Other | $6.5 million | 4% |

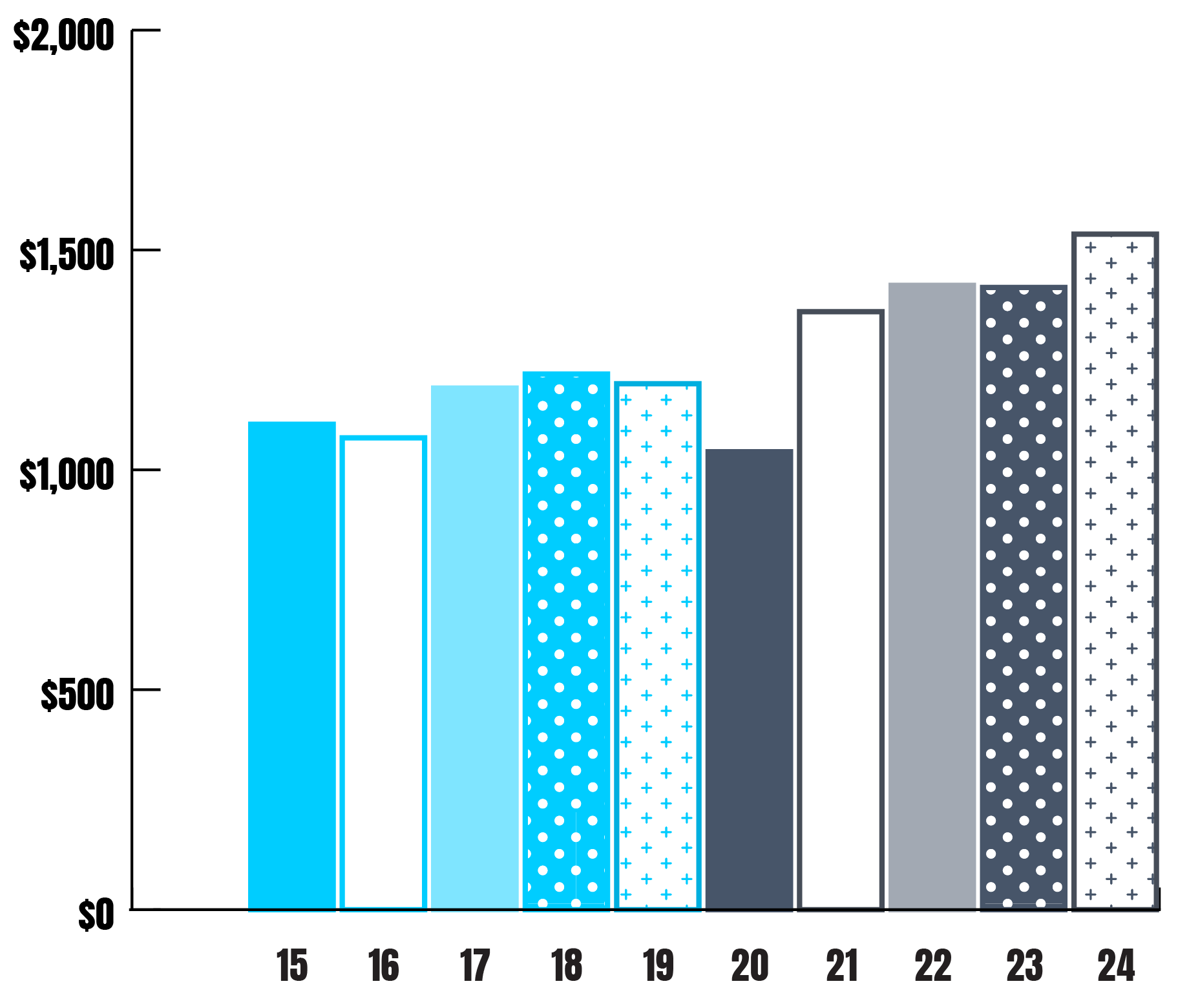

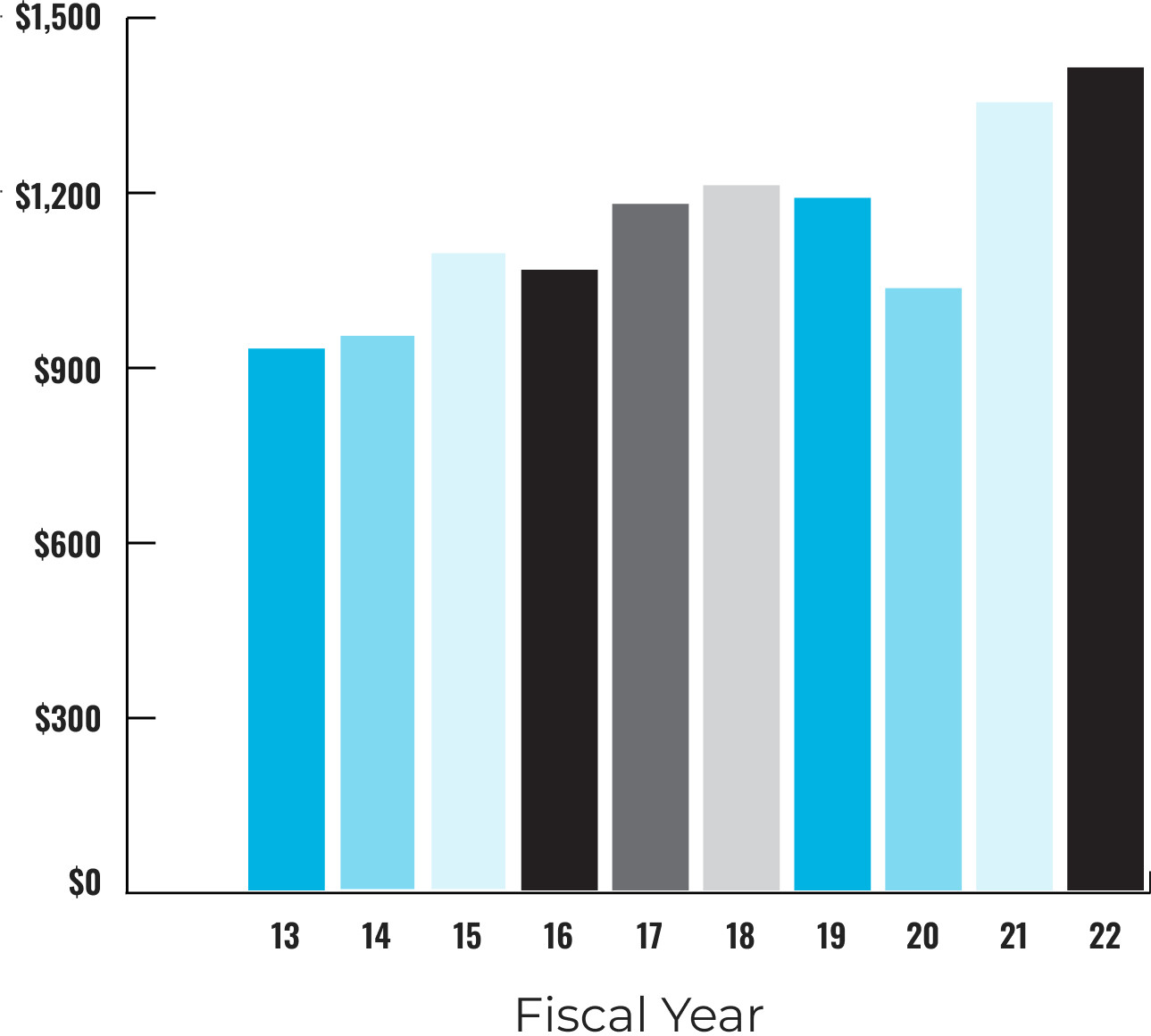

| Years | Total Assets in Millions |

|---|---|

| 2015 | $1,103.6 million |

| 2016 | $1,073.0 million |

| 2017 | $1,185.9 million |

| 2018 | $1,217.8 million |

| 2019 | $1,196.1 million |

| 2020 | $1,041.3 million |

| 2021 | $1,359.9 million |

| 2022 | $1,419.6 million |

| 2023 | $1,414.9 million |

| 2024 | $1,536.2 million |

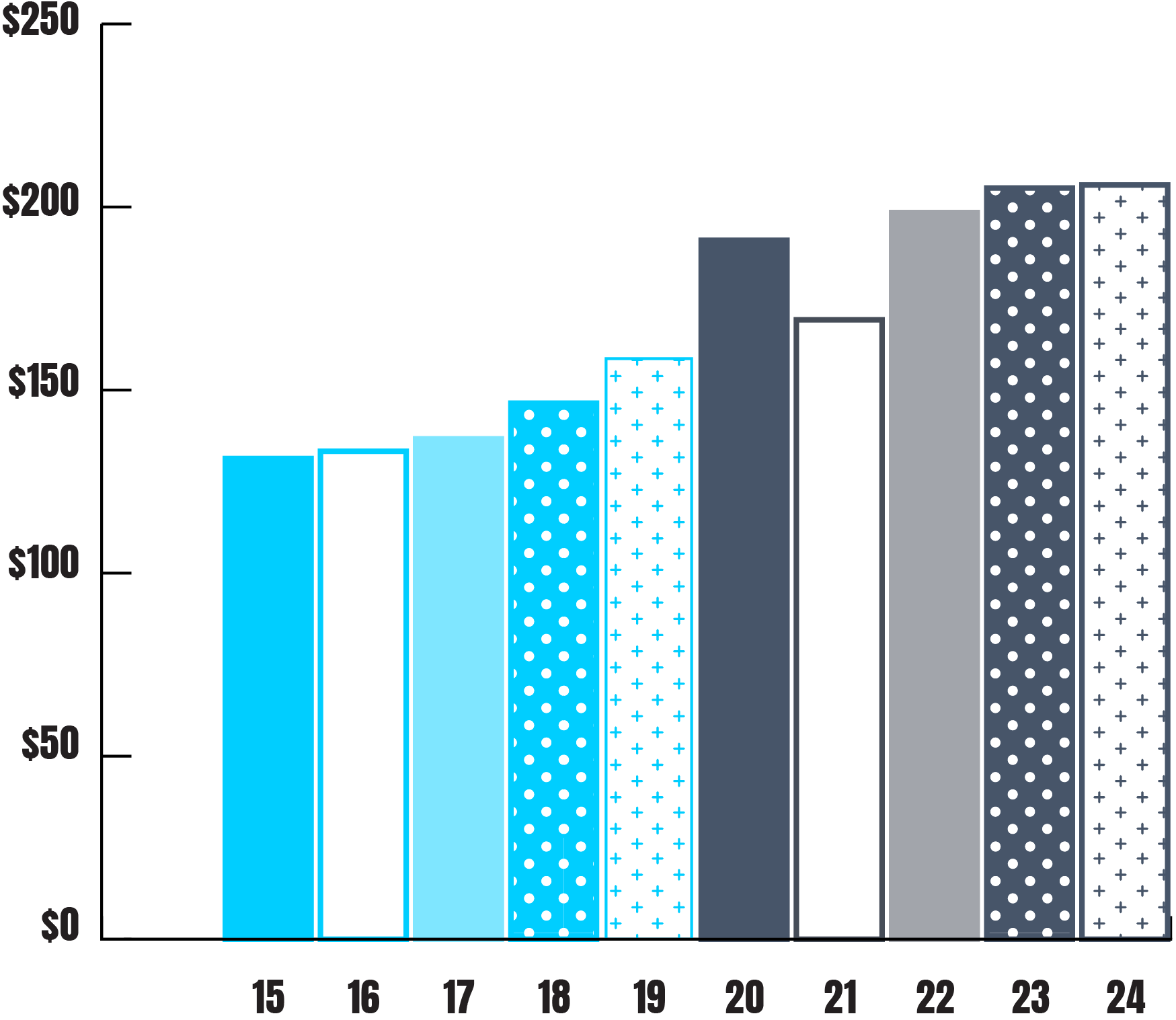

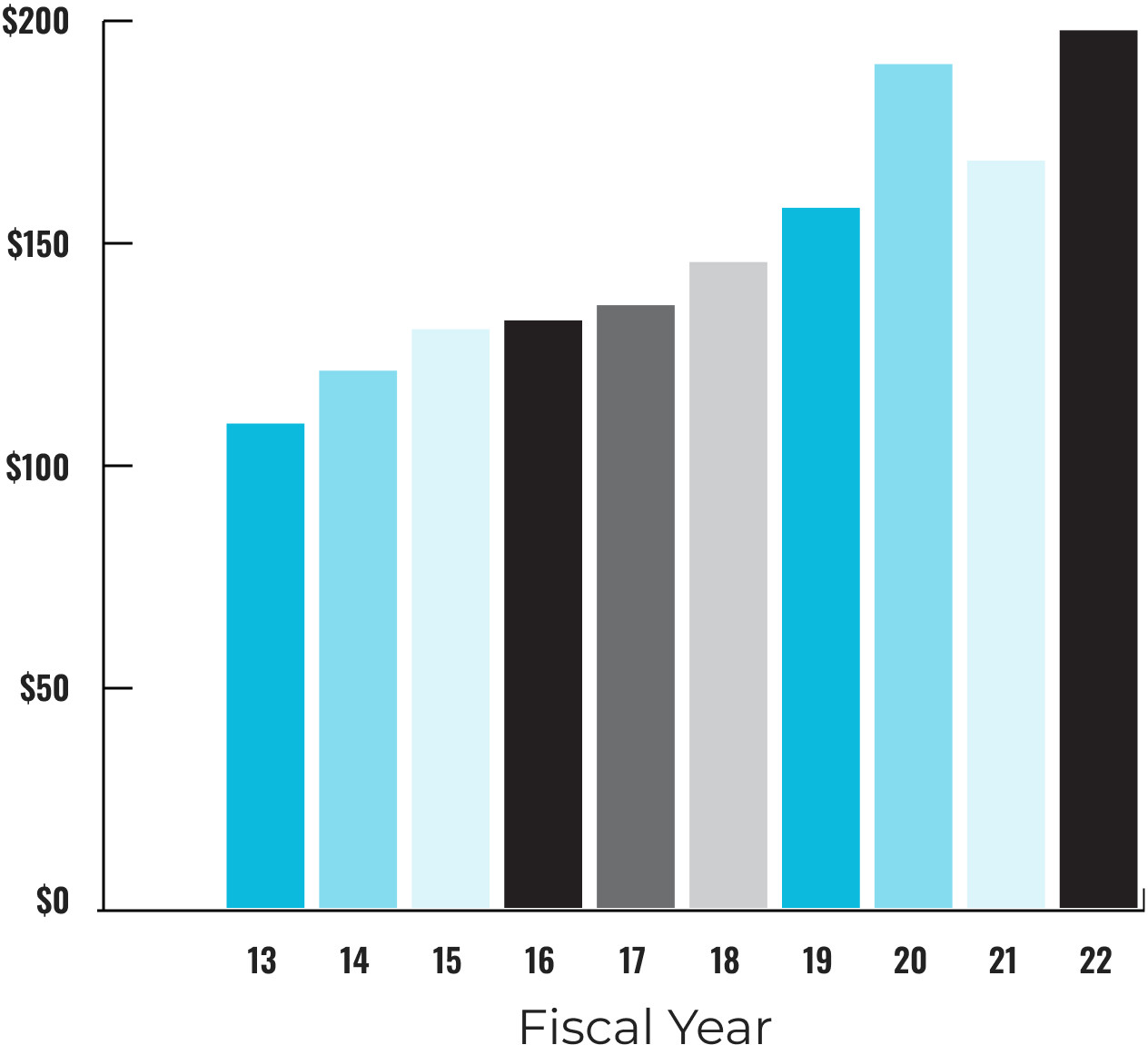

| Years | Total Revenue in Millions |

|---|---|

| 2015 | $131.3 million |

| 2016 | $133.3 million |

| 2017 | $136.7 million |

| 2018 | $146.4 million |

| 2019 | $158.6 million |

| 2020 | $190.9 million |

| 2021 | $169.5 million |

| 2022 | $198.5 million |

| 2023 | $205.2 million |

| 2024 | $206 million |

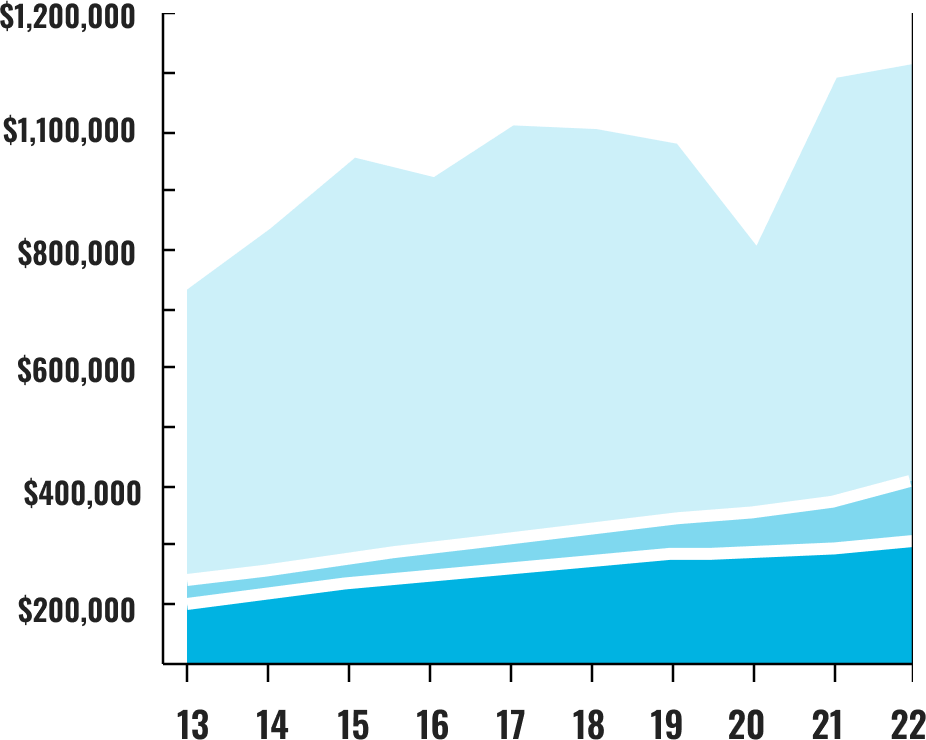

| Years | Total Revenue in Millions | ||||

|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | |

| Annualized rate of return percentage | 10.5% | 5.3% | 5.4% | 5.7% | 9.2% |

| Percentile ranking* | Top 76% | Top 84% | Top 100% | Top 90% | Top 1% |

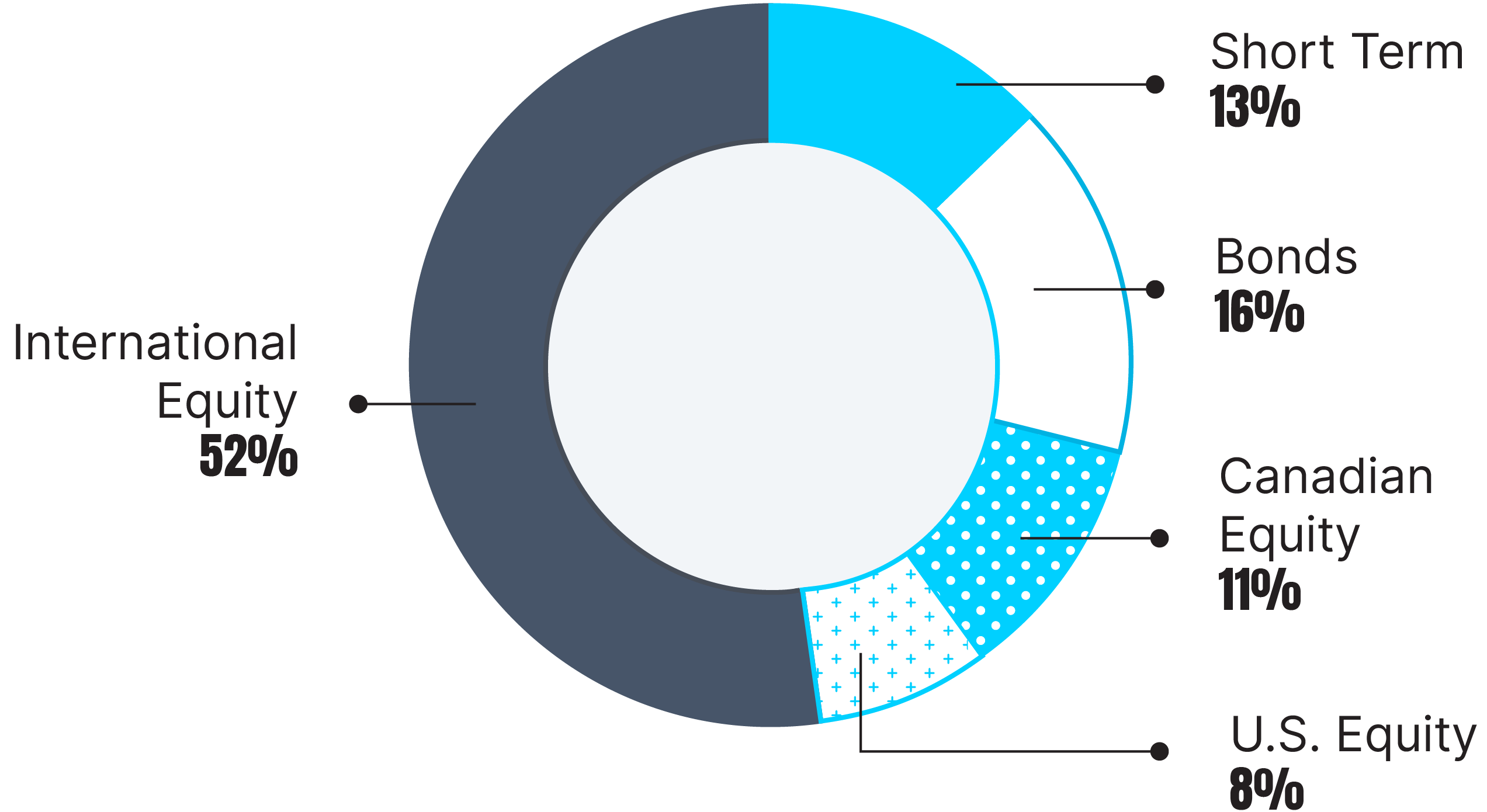

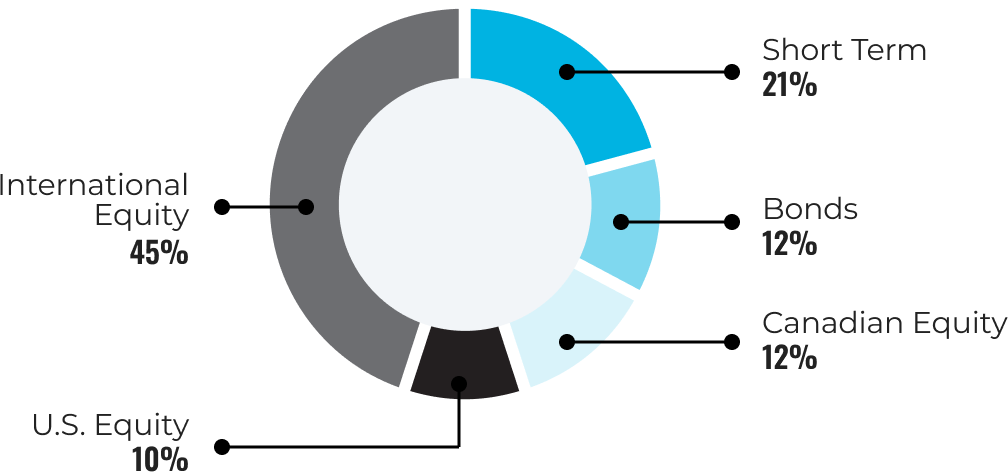

| Investment Asset | Percentage |

|---|---|

| Short Term | 13% |

| Bonds | 16% |

| Canadian Equity | 11% |

| U.S. Equity | 8% |

| International Equity | 52% |

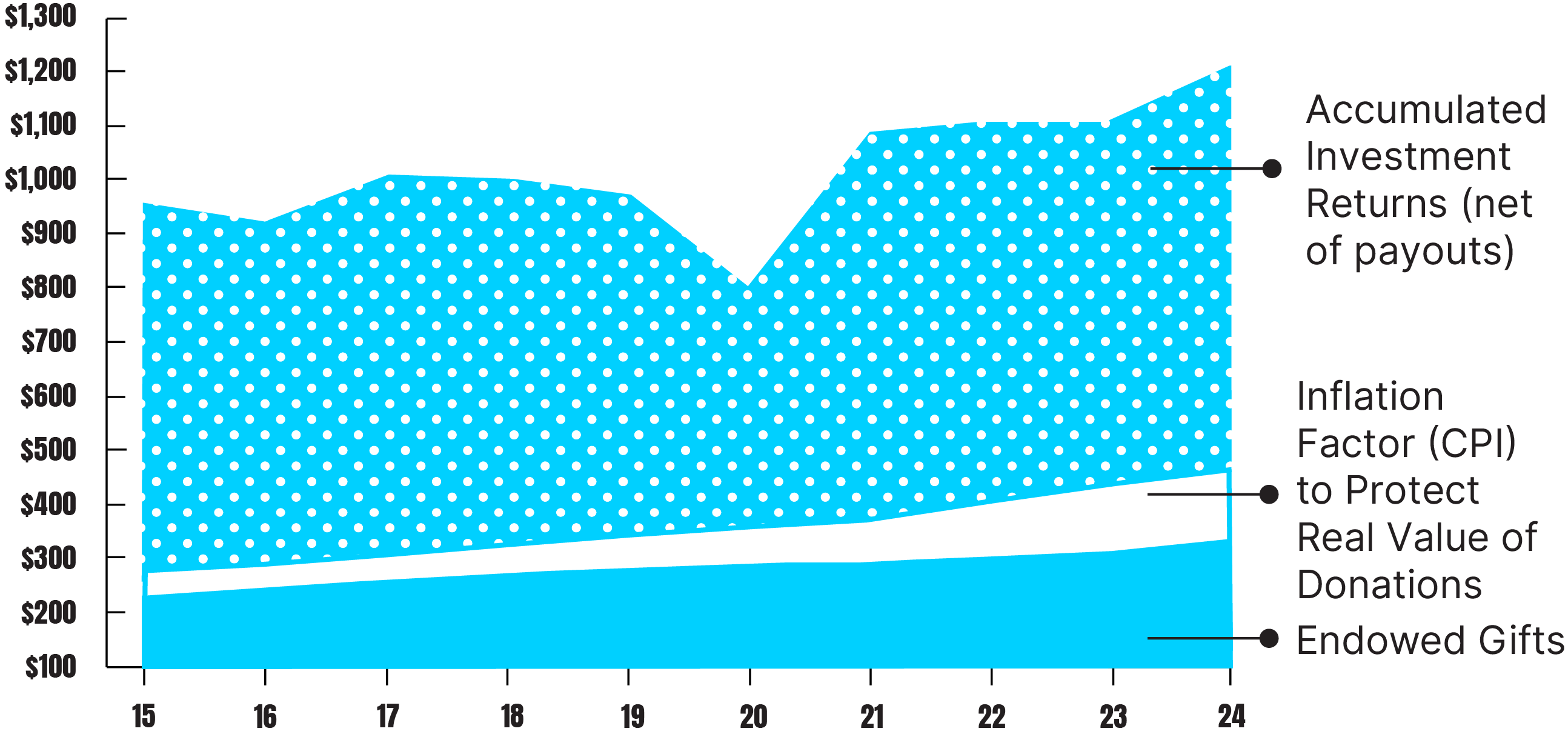

| Year | Total value of endowment fund | Rate of return for the year |

|---|---|---|

| 2015 | $959.3 million | 15% |

| 2016 | $925.9 million | negative 2.1% |

| 2017 | $1,013 million | 11.10% |

| 2018 | $1,005.7 million | 5.70% |

| 2019 | $981.7 million | 0.90% |

| 2020 | $806.8 million | negative 13.4% |

| 2021 | $1090.4 million | 28.50% |

| 2022 | $1,113.1 million | 3.20% |

| 2023 | $1,109.2 million | 2.10% |

| 2024 | $1,218 million | 10.5% |

Source of Revenue

(in millions)

Gross fundraising program, net lottery and net parking revenue

$213.7

Total grants and charitable activity (see below)

$175.1

Fundraising and administrative expenses

$60.9

Investments in Child Health

Grants and charitable activity (in millions)

Total Assets

(in millions)

Fundraising revenue

(in millions)

Total Assets

(in millions)

Fundraising revenue

(in millions)

Investment Management and Philosophy

Endowment funds at SickKids Foundation provide an important base of funding for child health initiatives. These funds largely consist of externally restricted contributions and internal resources, transferred by the Board of Directors, where the capital is required to be maintained intact over the long term. Each year, the Board approves the rate of payout, or distribution from the funds. The SickKids Foundation Board of Directors, through its Investment Committee, manages the Foundation’s endowed funds using a long-term, value-oriented investment philosophy.

The Committee believes that this philosophy best enables its objectives of preserving capital, enabling approved distribution (or payout), and realizing an average annual real total return after inflation of at least five per cent over a 10-year period. The Investment Committee regularly monitors the performance of the investment managers, selecting, appointing and releasing managers as required. The endowment fund continues to be among the top one per cent of performers when assessing returns since inception.

INVESTMENT RETURNS

10.5%

5.3%

5.4%

5.7%

9.2%

Top 76%

Top 84%

Top 100%

Top 90%

Top 1%

ENDOWMENT OUTPACES INFLATION

(IN THOUSANDS)

Investment Asset Mix